Cloud Marketplaces: How to Move “Tail Spend” to “Strategic Spend”

As macroeconomic pressures increase, it’s common to hear more in corporate hallways about “Tail Spend.” But what is it, and how can companies move this sometimes-shadowy expenditure into a strategic advantage for IT and DevOps teams?

TOC: Here are some answers to commonly asked questions:

- What’s Tail Spend?

- Where can I find Tail Spend in my company?

- How does a surge in growth with SaaS relate to Tail Spend?

- Is SaaS to blame for Tail Spend?

- How can I turn Tail Spend into Strategic Spend?

- How can an IT department change?

- How’s JFrog helping?

What’s Tail Spend?

Tail Spend refers to all the unmanaged high-volume and low-value transactions that take place within an organization. These are the canonical “nickel and dime” purchases that can add up over time, but often take just as much operational work as large, strategic purchases. Tail Spend Management actively manages this maverick spending by consolidating with a reverse 80–20: up to 80% of suppliers can account for 20% of procurement spend. Streamlining here can positively impact a firm’s financial performance due to its significant impact on operating margin.

Today, procurement departments face immense pressure to conduct responsible purchasing when commodity prices are volatile, and supply market risks are elevated. And while tail spend is a familiar concept for procurement groups, it’s challenging to optimize it correctly.

Regardless of size, every organization has encountered tail spend issues, whether they realize it or not. What can seem harmless in small doses, having your tail spend management under control can become a key competitive advantage.

Where can I find Tail Spend in my company?

Tail spend doesn’t include only low-value transactions. It’s not just the checkout-lane pack of gum that you won’t notice. In some organizations, it can consist of significant high-value purchases that are undertaken by a department to speed up a need within the business — a need-based purchase of an entire dinner for the whole family.

With the surge in SaaS-oriented companies (i.e., some estimates show up to ~30,000 SaaS companies) more businesses are turning to SaaS to address the increasing use of smartphones and app-based services and the extensive adoption of public and hybrid cloud. With the increasing adoption of artificial intelligence (AI) and machine learning (ML) across industries such as BFSI, healthcare, and IT & telecom, this has resulted in about 14B SaaS customers.

How does this surge in growth with SaaS relate to Tail Spend?

When SaaS is purchased by teams and organizations throughout the company, procurement leaders have very little visibility into an organization’s overall application spend and usage. In essence, the company bought a buffet dinner, but now has no idea how many guests came and ate, how much food was consumed or left, or how much it cost per guest.

SaaS growth is often left unchecked and unmanaged, and the amount of SaaS apps multiplies as more needs-based purchases are made. According to Better Cloud, organizations are using more SaaS apps than ever, from an average of 110 apps in a company last year, to 130 average apps in 2022’s organizations — an 18% increase. Meanwhile, large enterprises are using an average of 410 apps this year.

Is SaaS to blame for Tail Spend, then?

Not necessarily. SaaS has built a fast and easy way to develop solutions for customers, but it’s created a possible procurement manageability issue. The collective tail spend is glaring, and now companies are challenged to build relationships with their top strategic vendors when they own 100+ SaaS products. Many CIOs and their IT teams spend the vast majority of their “partnership time” with vendors like AWS, Microsoft and Google and the other vendors that provide critical infrastructure to the organization. Naturally, IT’s executive time is spent on the areas where the largest impact can be realized — on the “big meal” expenditures.

There are unrealized savings opportunities for this cloud “partnership time.” It helps identify “food chain” cloud SaaS spend — utilizing one cloud or multi-cloud — and helps remove redundant contracts, opens up cash flow, and frees up budget for new projects and expansion potential.

How can I turn Tail Spend into Strategic Spend?

Marketplaces become a central procurement vehicle to consolidate SaaS spend. However, this isn’t just a virtue of online marketplaces — it’s an example of an entirely new economic model for business, one that’s just beginning to show its power.

Tail spend is starting to become strategic spend as you look at SaaS products that are dominant across a company. If you’ve planned to retire a certain percentage of your cloud spend, and have extra, you can offset a current cost with consolidation of your Tier 1 SaaS products. You balance out your costs.

For example, as we continue to weather possible lows in the economy, we must look at how we “pull back” the surge we had in 2020. When COVID hit, consumers went all in. Consumer appetite for digital and contactless ways of shopping and interacting with companies has radically increased. In response, companies across all industries quickly sought to change their priorities and operations. The digital transformation revolution hit light speed. According to an August 2020 report from Periscope by McKinsey, “in a matter of 90 days, we vaulted forward ten years in United States e-commerce penetration.”

The true driver behind digital transformation for many organizations rapidly became the speed at which they could experiment and launch new digital services. And this leads us back to the pressures put on procurement — having to adjust to short term buying cycles in the dynamic — and sometimes less-traceable — world of the cloud.

How can an IT department change?

In a decentralized, auto-scaling cloud context, the “old” procurement model with centralized accounting, budgeting and months of lead time doesn’t allow the flexibility needed to rapidly respond to market changes or customer demands. Additionally, when DevOps, security, and IoT functions have product and engineering teams delivering new software features in hours vs. days, it’s unreasonable to expect their scalability needs can be satisfied by finance and procurement processes that work in fiscal quarters and years.

Looking at your priority SaaS products, working through a consolidation of your cloud spend just makes sense. The benefits of agility, elasticity, cost savings, ease of deployment, ease of management, ease of procurement, and ability to leverage cutting-edge technologies become budget friendly.

SaaS adoption continues to be significant, and will be a driver for change for the foreseeable future. Gartner expects steady velocity within this segment as enterprises take multiple routes to market with SaaS, for example via cloud marketplaces, and continue to break up larger, monolithic applications into composable parts for more efficient DevOps processes. Essentially, we will all continue to prepare parts of the meal individually to make them great.

How’s JFrog helping?

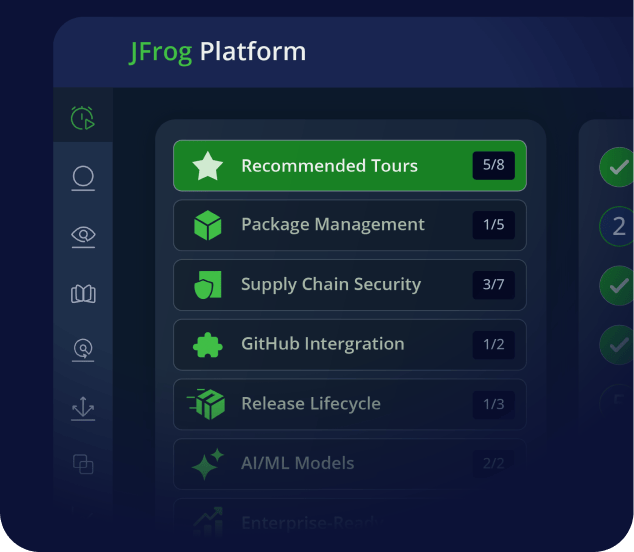

JFrog is working with our cloud partners to help consolidate spend and also co-design your DevSecOps platform built for public cloud and working together to help you migrate into an SaaS-based or hybrid model. Tool consolidation, maintenance spend and more are all on the table in most board rooms to streamline costs and provide efficiency.

Let’s prove it together. For a streamlined proof of concept (POC) on the cloud of your choice, contact us at cloud@jfrog.com.

For more information on our cloud provider partnerships, please visit the following pages: